17/11/2021 Jocelyn Sheltraw of Headset is here to drive a data and technology-driven mindset for brands to know the cannabis market and thrive in it.

Jocelyn Sheltraw, Cannabis & Consciousness at Headset is responsible for internal and external strategies to build Headset's brand awareness, community development, and market expansion across North America. Jocelyn is a vocal cannabis advocate and industry thought leader, involved in various cannabis associations, committees, social equity programs, as well as a regular speaker at various industry events, podcasts, and webinars.

Tell us about yourself and your origin story in Cannabis.

I'm about 3.5 years into the cannabis industry, and grateful for every day of this journey.

I came to be a part of the industry through manifestation. Right after graduating college, the iPhone came out and my first real gig was working for an agency that built mobile apps and websites. Being a part of a new and emerging industry, and working on some of the biggest apps for 10 years, was really fun for me. Initially, I started looking at the cannabis industry because I wanted to experience another high-growth industry and help build brands at the onset like I had in tech. I'm really attracted to high-growth, emerging industries. I like change, and instability...keeps life interesting.

Anyways, I was introduced to our CEO, Cy Scott, through a former colleague about 5 years ago, and he told me what he was building with Headset. Prior to Headset Cy, along with our 2 other co-founders Brian Wansolich and Scott Vickers, founded Leafly together, so given my work in the app world, I had great respect for them as individuals and what they’ve built together.

Fortunately, my interests manifested, and I joined the team 3.5 years ago to lead the new market expansion. That role has since developed, and now I focus on building awareness and strategic relationships across the US and Canada.

I feel like my past and present interests have collided, and it’s wonderful. I've been a lover of the plant for about 15 years, and I consume it regularly. Mostly to transition my state of mind. Cannabis is purely of recreational and spiritual interest to me....it's nice to change our mindsets and have a new perspective, and cannabis can help do that.

In Frame: Jocelyn Sheltraw

Almost immediately upon joining the industry, my life changed. I had no idea that being a part of something bigger than myself would transform the way I look at the world and the opportunities that would become available because I’m living with purpose. I’m inspired to share my journey and everything I’m learning in hopes that it will help others live their fullest and most authentic life.

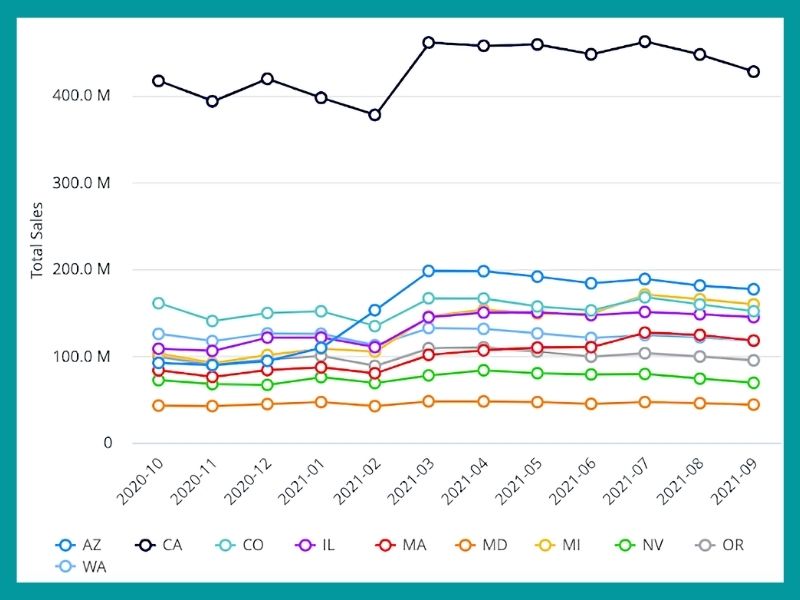

Give us a macro-level insight into the US Cannabis market. Which are the 5 top states for recreational cannabis sales?

According to the markets we're tracking at Headset, the top 5 states in terms of monthly sales are California, Arizona, Michigan, Colorado, and Illinois.

Obviously, there's a lot of nuances when it comes to sales by state. Total population sizes, licensing dynamics, product regulation and availability, the existing cannabis culture...these things all contribute to a market's sales growth.

For example, if you look at California, which has the largest sales by state by a longshot...it makes sense when you think about the total population of over 40M people, a wide variety of products available (some states are limited in what they can sell), an ethos of entrepreneurship and innovation, and a long-standing cannabis culture, including a medical cannabis program since 1996. However, I do wonder what sales will look like when more counties open up to retail and manufacturing...on the retail side, there are around 800 licensed storefronts, which is comparable to Oregon, which has around a population of 4M people. This isn’t enough stores to service demand, which is just one factor as to why California sees a thriving illicit market.

Insight into the US Cannabis market

Which are the fastest-growing states by Cannabis sales?

While cannabis sales in each state are generally growing every month, the growth rates certainly differ by market. I believe growth rates have a lot to do with market maturation, licensing and policy, social acceptance and cannabis culture, and how big the illicit market is.

Naturally, states that are just opening up adult-use sales are going to see higher growth rates than more mature states. Arizona is seeing the highest growth rates right now. It was pretty incredible to see adult-use sales pass in the November 2020 election, and just 2 months later (by end of January) recreational sales began. No state has transitioned to adult-use that quickly, which I think is really cool to see, and a great example of people coming together and moving quickly.

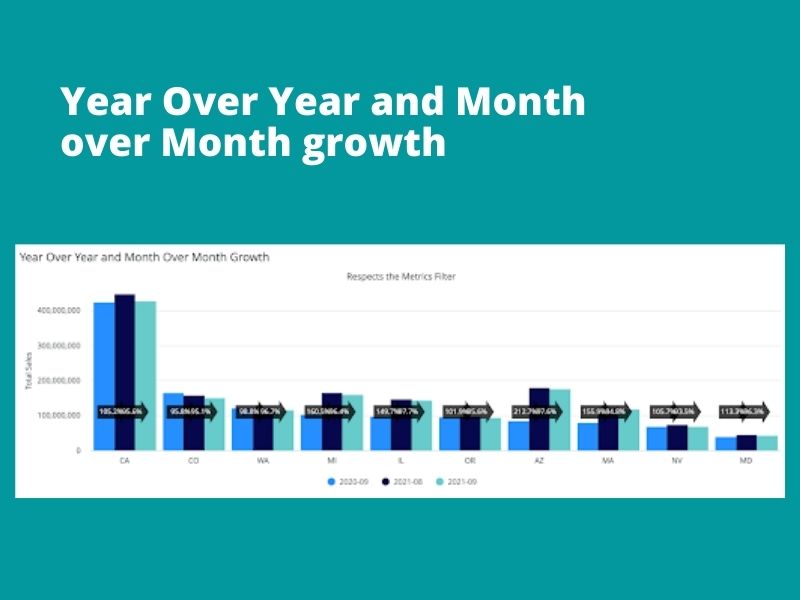

East coast states are also growing quickly...Illinois, Massachusetts, and Michigan, all-seeing growth rates between 150-160% from sales in September 2020 to September 2021.

Really looking forward to recreational sales starting in New York and New Jersey, and how normalization from these mega states impacts sales across the US.

Year Over Year and Month over Month growth

Where is the money going in Cannabis, which top category is getting capital?

Depends on what state and part of the industry you’re talking about. From 2018 through 2020, the industry saw big investments in ancillary and technology... mostly due to the instability of the markets and regulations when it comes to investing in plant-touching businesses.

Capital markets are opening up again, and I hear a lot of my investor friends expressing more interest in plant-touching companies, and interest seems to be across the board of what category they’re interested in depending on many dynamics.

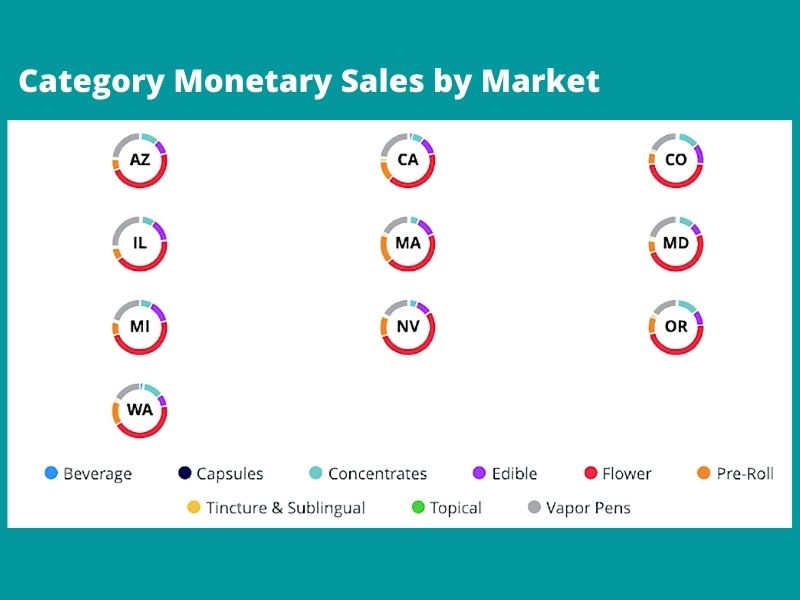

For example, Beverage sales generally make up between 1 and 2% of overall sales in each state, it’s much smaller than most people think, but there is a lot of interest in investing in this category because it’s attracting so many new consumers, and therefore is seeing high growth rates. Whereas loose Flower generally makes up in the mid-’30s to 40% of sales in a state but has been seeing declines the last year (likely due to so many new products/categories, plus a retraction and return to provide sales).

The challenge for investors on the plant-touching side is that without federal legalization or some change in interstate trade, national expansion is tumultuous and costly, and therefore too risky for many.

Building a brand is also really hard because consumers don’t have a lot of loyalty at scale yet...most are buying on price point and THC level, and with limited advertising options to build a brand and change people’s mindset on a product, it’s hard to become the next big CPG brand.

Jocelyn Sheltraw, Cannabis & Consciousness at Headset

According to you, what are the main challenges that the industry is facing?

There are a lot of challenges in the cannabis industry...a lot is stacked against a business from the onset. I think access to capital, supply chain issues, high taxes, and non-business friendly policy, constantly changing regulations, thriving illicit markets, and inexperienced business owners that can navigate these waters make it very hard to run a profitable business.

Then on the brand side, creating great tasting, consistent products is hard. And retail distribution, staying top of the mind with stores and budtenders, is even harder. It’s very costly, and a constant grind. My partner has been running a cannabis concentrate company in California for the last 6 years and seeing everything his team goes through on a daily basis to navigate this industry is pretty astounding.

This industry is tough because most people don’t like instability and change. People often don’t understand how tough it is to navigate, and so I’ve seen quite a few bright-eyed friends leave the industry as fast as they came in.

Lastly, on the consumer side, there’s still a lot of miseducation and misinformation on many fronts...just google “cannabis” and see the mass differential of narrative in the media headlines. Some people are getting introduced to cannabis for the first time and being that the industry is so new, there’s a lot of different expectations and understandings...this will take years of education and normalcy to address.

Where do you think opportunities will be for cannabis brands in 2022?

Brands will have opportunities to innovate and build products in all categories, but I think they’ll face many of the same challenges they’ve faced this year. It’s really hard to create a quality product, market that product, get retail distribution, and be profitable enough to have the budget to build consumer loyalty.

That being said, I have confidence that the brands that have defined their ethos and know who they are, who they’re creating products for, have enough capital to sustain growth, and have the right team members leading, there is so much opportunity. Even when some change happens where running a business gets easier, that’s when you’re going to have more competition, which is a different challenge. I saw this in the app gaming world...it was crazy to see a mobile game be so popular one day, and a year later not be around.

The same thing is happening in cannabis...it’s interesting to watch the Headset data and see how one brand will be at the top and another will quickly come in and take market share in what seems like overnight.

There is an unlimited and untapped opportunity at this point, which is super exciting, but brands have to be able to navigate a lot, and it’s really hard.

Category Monetary Sales by Market

Thoughts on Cannabis beverages?

I love the cannabis Beverage category, and it’s been fun to see so much product and branding evolution over the last 2 years. Though beverages are a small percentage of cannabis sales at this point, I’m particularly excited about the category because it’s bringing in new and first-time consumers, which is helping destigmatize the plant overall. Just think about all the women and moms giving it a try for the first time.

Personally, I rarely consume cannabis beverages. I’m a Flower girl and a purist to the plant, but I do look forward to the day when I can enjoy a cannabis beverage at a bar as opposed to alcohol.

Thoughts on Cannabis Edibles?

Edibles continue to see strong sales and growth rates...in most states Edibles are around the 3rd or 4th largest category of sales, generally making up around 10-20% of total cannabis sales. And of those Edible sales, people really like Gummies (generally makeup about 70-80% of the category's total sales).

I think there is a lot of room for innovation. One innovation we’ve seen recently is the fast onset of technologies, which was the result of many people finding edibles scary due to inconsistency of experience...i.e. not knowing when it will kick in. Many companies now have a fast onset, which I suspect will lead to continued growth for the brands and category.

Personally, I want to see more low-dose package edibles...like who wants to eat just 2 tiny gummies? I want to have more but in lower doses.

Meet Jocelyn at the 2021 Cannabis Drinks Expo Conference, San Francisco. She is going to speak on - "Cannabis Beverages: current trends & future predictions"

For more info, visit cannabisdrinksexpo.com

TAGS: